Guide for Buyers and Sellers on Acquire

Sep 21, 2024

Acquire is a leading platform for buying and selling startups, offering comprehensive tools and support for buyers and sellers. Whether you're looking to sell your SaaS startup or acquire a thriving business, this guide provides detailed insights into maximizing the platform's features and navigating the transaction process smoothly.

For Sellers

Create Your Listing

Acquire makes it easy for sellers to list their SaaS startups and reach over 500,000 verified buyers. The platform equips sellers with powerful tools that simplify the listing creation process. These tools help you present your startup attractively, showcasing key aspects such as performance metrics, financials, and unique selling points that appeal to prospective buyers.

You will also receive guidance on best practices for structuring your listing to ensure it captures the right buyers' attention. Your listing is crucial as it serves as the first impression of your business, so it's important to be thorough and clear in your descriptions.

Learn more about creating your listing on Acquire.

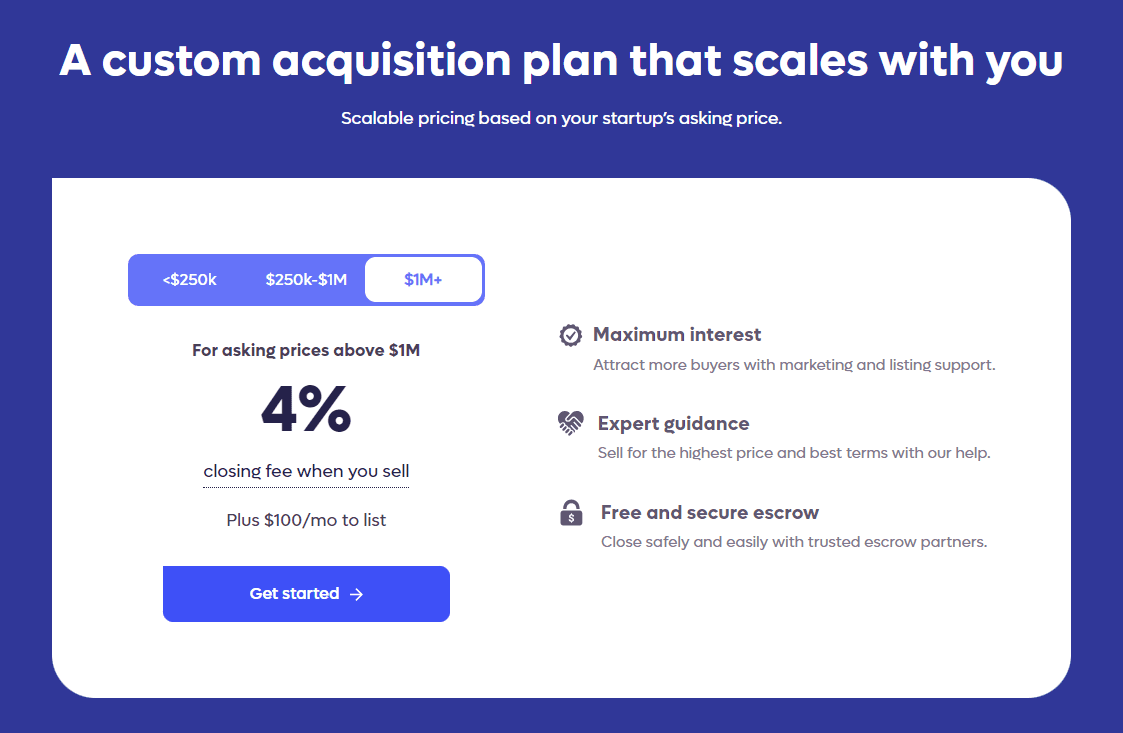

Pricing Options

Acquire offers flexible, scalable pricing options that allow sellers to choose the plan that best fits their startup's size and growth stage. The platform's pricing structure is designed to be straightforward, with fees based on the startup's asking price. This ensures that sellers only pay for the level of service they need, whether they're listing a smaller business or a more established enterprise.

Here's a breakdown of the pricing tiers:

For asking prices below $250k:

Sellers pay a 6% closing fee when the sale is completed, plus $25 per month to list their business.

For asking prices between $250k and $1M:

Sellers pay a 5% closing fee when the sale is completed, plus $50 per month to list their business.

For asking prices above $1M:

Sellers pay a 4% closing fee when the sale is completed, plus $100 per month to list their business.

In addition to this scalable pricing, sellers also gain access to valuable tools such as the Free SaaS Valuation Tool, which helps you assess your startup's value before setting an asking price. Acquire's team provides personalized guidance to assist you throughout the listing process, ensuring you get the most value from your sale.

Explore pricing options for sellers.

Additional Support

For sellers looking for hands-on support throughout the acquisition process, Acquire offers the Guided by Acquire service, a white-glove advisory program that simplifies selling your SaaS startup. This service is ideal for founders who want expert guidance, from preparing their startup for sale to finalizing the deal.

Here's how Guided by Acquire works: you'll be paired with a dedicated M&A advisor who will work with you to sell your SaaS business for the best possible price and terms. Your advisor will draft a custom acquisition plan, market your startup to Acquire's top buyers, and help you evaluate offers. They will guide you through every acquisition stage, including negotiations, due diligence, escrow, and asset transfer, ensuring a smooth and successful sale.

Key highlights of Guided by Acquire:

Personalized M&A support: Your advisor helps market your listing to vetted, qualified buyers based on your criteria.

Comprehensive assistance: From drafting acquisition offers (IOIs, LOIs, APAs) to closing the sale, your advisor will assist you at every stage.

Performance-driven pricing: You only pay a 4% closing fee when your startup is successfully acquired, with no upfront or hidden costs.

Higher buyer interest: Sellers using the service see up to 400% more buyer interest, which can help increase the final sale price.

The service is available for SaaS startups with at least $100,000 in trailing twelve months (TTM) revenue, focusing on startups generating $5 million or more in annual revenue.

While Guided by Acquire isn't mandatory, many founders find securing the best deal quickly and efficiently invaluable. With no additional upfront cost, you have nothing to lose and everything to gain from having expert support during this crucial phase of your business journey.

Learn more about Guided by Acquire.

For Buyers

Browse for Startups

Acquire provides buyers access to a vast marketplace of hundreds of vetted startups, making it easy to find businesses matching your interests and investment criteria. The platform offers robust search and filter tools, allowing you to streamline the browsing experience and quickly identify startups that align with your acquisition goals.

Based our monitoring over the past few months, Acquire has consistently had 700+ available listings, and recently crossed the 800 mark. New listings are added daily, making it a good place to check frequently.

In terms of prices, you'll find businesses anywhere from $1K all the way up to $75M. At time of writing, the median price of a business on Acquire is $63.5K and the total volume listed is $463.7M. You can view these live stats directly on our platform by visiting the brokers/marketplaces page.

You can filter listings based on several key factors, including:

Revenue: Filter startups by their trailing twelve months (TTM) revenue to focus on businesses that fit your financial capacity and growth strategy.

Business model: Whether looking for SaaS, e-commerce, or other types of startups, Acquire lets you browse businesses according to their model.

Industry: Focus on startups operating in industries you're familiar with or interested in expanding into.

Geographic location: Narrow down businesses based on their location, particularly if you're targeting specific markets or regions.

For more filtering and searching options, try viewing Acquire's businesses for sale on our platform.

Business Models Available

Acquire features startups with a variety of models, allowing buyers to explore based on their investment preferences:

SaaS (Software as a Service): Startups that provide subscription-based software solutions with recurring revenue streams.

E-commerce: Online businesses selling physical or digital products, including dropshipping and direct-to-consumer (DTC) models.

Affiliate: Websites generate revenue through affiliate marketing by earning commissions on referred sales.

Content sites: Businesses that monetize through advertising, sponsored content, or membership models.

Mobile apps: Startups earn revenue via in-app purchases, advertising, or premium subscriptions.

Marketplaces: Platforms connecting buyers and sellers, earning money through transaction or listing fees.

For more granular control over filtering Acquire's listings by model/monetization, our aggregated feed of online businesses for sale features enhanced categorization.

Key Information of Each Card

When browsing startups on Acquire, each listing provides a snapshot of crucial details, allowing buyers to assess the business's potential quickly. The information displayed on each card helps you determine whether the startup fits your acquisition criteria. Here's what you can expect to see:

Asking Price: The seller's asking price for the startup is visible, giving you a transparent view of the required investment.

Revenue Multiple: You'll see the multiple of revenue the asking price represents, which helps gauge the valuation relative to the startup's performance.

TTM Revenue: The trailing twelve months (TTM) revenue is displayed, giving insight into how much the startup has generated over the last year.

TTM Profit: The startup's profitability for the past twelve months is also listed, helping you assess its financial health.

Last Month's Revenue and Profit: Performance data for the most recent month is included, allowing you to track current trends in the business.

Growth Rate: Many cards show the annual growth rate, helping buyers see whether the business is progressing.

Business Model: The startup's business model is identified (e.g., SaaS, e-commerce, subscription), so you can focus on businesses that align with your expertise or acquisition goals.

Customer Metrics: Some cards also provide key customer metrics, such as the number of active customers or users, and metrics like annual recurring revenue (ARR) or churn rates.

When you click into the listing, more detailed information becomes available, such as financial breakdowns, growth opportunities, tech stack, competitors, and other key data that help you fully understand the business before making an offer.

This clear and concise card layout helps streamline the browsing experience, letting buyers focus on opportunities that fit their investment strategy and goals.

Learn more about browsing and searching for startups

Pricing Plans for Buyers

Acquire offers flexible pricing plans tailored to different buyer needs, helping you find the right startups for your investment goals. Whether you're just starting or are a professional acquirer, these plans provide access to a wide range of startups and features:

Basic (Free): This entry-level plan provides access to public listings, allowing first-time buyers to explore startups at no cost. It's a good starting point to familiarize yourself with the marketplace.

Premium ($390/year): This plan is ideal for buyers targeting startups with up to $250,000 in trailing twelve months (TTM) revenue. With a Premium subscription, you gain access to a larger pool of listings and can communicate directly with founders, making it easier to explore viable acquisition opportunities.

Platinum ($780/year): The Platinum plan unlocks the full range of startups on the platform, including those generating more than $250,000 in revenue. Platinum subscribers also benefit from priority support, allowing them to receive faster assistance and expert advice from Acquire's in-house M&A advisors, which is particularly valuable when closing high-stakes deals quickly. Additionally, Platinum buyers gain access to businesses managed by Acquire's team, increasing their chances of finding the right acquisition.

Both Premium and Platinum subscriptions allow buyers to acquire multiple startups, with Platinum providing access to all listings, regardless of revenue. If you ever want to upgrade from Premium to Platinum, Acquire offers a simple process to apply the remaining value of your Premium subscription toward your Platinum upgrade.

The Platinum plan is a worthwhile investment for buyers seeking a comprehensive experience with more access to higher-revenue startups and faster deal support.

Learn more about pricing options for buyers.

Make Offers and Due Diligence

Once you've found a startup that fits your acquisition goals, Acquire makes it easy to submit offers and navigate the due diligence process. The platform provides tools to streamline every step, helping you move smoothly from initial interest to finalizing the deal.

When ready to make an offer, you can submit a Letter of Intent (LOI) directly through Acquire. This document outlines your intent to purchase and provides a starting point for negotiations. After submitting the LOI, you and the seller can discuss terms and address any concerns to reach a mutually beneficial agreement.

Following the LOI, due diligence is the next critical phase. During this stage, you'll review the startup's financials, operations, and other key information to ensure the business meets your expectations. Acquire supports you throughout this process by facilitating access to the data you need and offering expert advice on what to look for during your evaluation.

Once due diligence is completed and both parties agree to the terms, you can proceed with the Acquisition Purchase Agreement (APA), which formalizes the transaction. Acquire offers escrow services to ensure a safe and secure transfer of assets and funds, minimizing risks for both buyer and seller.

For buyers needing additional support, Acquire also offers resources for securing financing, helping you confidently complete the acquisition.

Learn more about buyer’s guides here.

Free Valuation Tool

For those seeking additional insights, the Free SaaS Valuation Tool can be used to assess the financial health of startups you are interested in. This ensures you comprehensively understand the business’s worth before making a final decision.

Conclusion

Acquire is a comprehensive marketplace that connects buyers and sellers of SaaS startups. With tools and services designed to simplify and streamline the transaction process, it's a valuable resource for entrepreneurs looking to sell their businesses and buyers seeking growth opportunities. Whether using the platform's free tools or taking advantage of premium plans and personalized support, Acquire provides all the necessary resources to ensure successful transactions for both parties.